Discover options to finance your education in Pakistan with a complete guide to student loan in Pakistan. Learn about eligibility, loan types, interest rates, repayment plans, and more!

Table of Contents

What is student loan?

Financial wellness for higher education is essential for personal and professional development, but paying for it can be challenging, especially in Pakistan. While scholarships and grants are ideal options, they are not always available to everyone. For many students, student loans have become a compulsory alternative. This article will help you understand the several student loan options available in Pakistan, ensuring you make informed financial decisions for your education.

Pakistan Government Schemes Student loan in Pakistan

The National Student Loan Scheme (SLS) is a key government initiative to help students finance their education expenses. The SLS is provided in collaboration with different banks, offering loans intended for tuition fees and maintenance costs.

Eligibility Criteria

Students are eligible to apply for loans under the scheme if:

- He or she has been admitted to one of the public sector universities or colleges approved by this section on the basis of merit.

- At the time of admission, he or she is in the following age range:

- For Graduation: Not exceeding 21 Years

- For Post-Graduation: Not exceeding 31 Years

- For Ph.D.: Not exceeding 36 Years

- He or she secured 70% marks in the last public examination.

- He or she has undertaken the study of the subjects given below.

- He or she is unable to pursue studies due to financial constraints.

Loan Types

The loan facility will be available throughout the study for the following:

- Schedule Fee ( Paid directly to the university or college)

- Boarding expenses, excluding meal charges

- Procurement of textbooks—disbursed directly to the student

Repayment Terms and Interest Rates

The maximum period of loan repayment is 10-years from the date of disbursement of the first installment. After six months from the date of first employment or one year from the date of completion of studies, whichever comes first, the borrower is required to repay the loan in monthly installments.

Example: We spoke to Aisha Khan, a recent beneficiary of the SLS, who shared, “The SLS was a game-changer for me. It covered my tuition fees, and the income-based repayment plan made it manageable post-graduation.”

For more information, visit the HEC website.

Approved Subjects

- Engineering

- Electronics

- Oil Gas & Petro-Chemical Technology

- Agriculture

- Medicine

- Physics

- Chemistry

- Biology, Molecular Biology & Genetics

- Mathematics

- Other Natural Sciences

- DAWA and Islamic Jurisprudence (LL.B./LL.M. Sharia)

- Computer Science, information System and Technology, including hardware.

- Economics, Statistics and Econometrics

- Business Management Sciences

- Commerce.

An interest-free loan

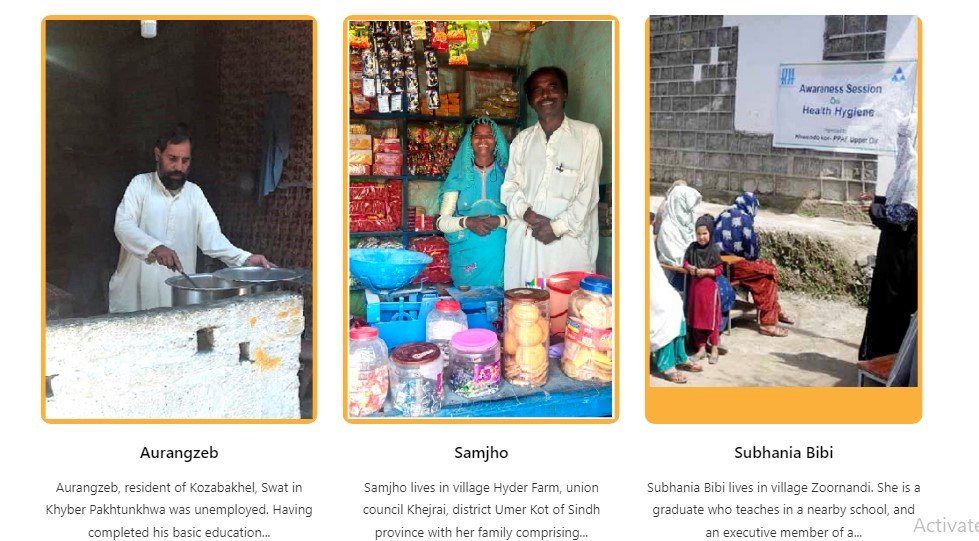

Pakistan Poverty Alleviation Fund (PPAF) is an organization dedicated to poverty alleviation and sustainable development in Pakistan. One of its main projects is the National Poverty Graduation Program (NPGP), which aims to help poor communities. Pakistan escapes poverty by integrating security and increasing access to health and wealth.

NPGP, with support from the International Fund for Agricultural Development (IFAD) and the Government of Pakistan, received the first international recognition of poverty from PPAF in 2008.

Interest-free loans are included to provide financial services to citizens in over 100 cities of Pakistan, including Punjab, Sindh, Balochistan and Khyber Pakhtunkhwa, as well as Islamabad Capital Territory, Gilgit · Baltistan and Azad Jammu and Kashmir (Pakistan Poverty Alleviation Fund). The initiative is part of PPAF’s broader strategy to increase business, promote social inclusion and improve the quality of life of the poor (Pakistan Poverty Alleviation Fund).

Private Banks Offer Student Loans

Private Banks in Pakistan also offer student loans with various features and terms.

Loan Types

● Undergraduate Loans: For bachelor’s degree programs.

● Postgraduate Loans: For masters and doctoral programs.

Interest Rates and Repayment Terms

Private loans may have fixed or variable interest rates, depending on the borrower’s wealth. Repayment terms are typically flexible, with options for payment holidays during phases of financial poverty.

Analysis: Comparing banks like HBL, UBL, and MCB, we found that HBL offers the lowest interest rates for students with excellent credit scores, while MCB provides more flexible repayment options.

For detailed comparisons, visit their respective student loan pages:

Eligibility and Application Process

For updated details, you may visit the specific bank website by following the link provided above.

General Eligibility Criteria

- Merit: Academic performance is often considered.

- Program: Students have to be enrolled at an accredited college or university.

- Financial Need: Demonstrated need for financial assistance.

Application Process

- Gather the required documents: Academic records, admission letters, proof of income, and identity documents.

- Submit the application: Visit the bank’s online portal or in-person at a branch.

- Approval and Disbursement: The bank reviews the application and, upon approval, disburses the funds.

To stay updated on the latest procedures, refer to government resources or consult with bank representatives.

Considerations to Make When Choosing a Student Loan

Take into account the following aspects when choosing a student loan:

- Interest Rates: Fixed vs. variable rates.

- Repayment Terms: Flexibility and length of repayment period.

- Processing Fees: Additional costs associated with loan processing.

- Repayment Flexibility: Options for deferment or payment holidays.

- Co-Signer Requirements: Necessity of a Guarantor.

Financial Planning and Responsible Borrowing

Proper financial planning is crucial when taking on student loans. Here are some tips:

- Budget Wisely: Track your expenses and create a budget.

- Explore Scholarships: Use credible websites like Scholarship Positions for opportunities.

- Work Part-Time: Balance part-time work with studies to ease financial pressure.

Success Story: Ali Hassan managed to balance his part-time job with his studies, significantly reducing his reliance on loans. He stated, “Working part-time helped me cover my living expenses without having to worry about repaying my loans.”

Conclusion

By understanding the eligibility criteria for student loans, loan types, and repayment terms, students can make informed decisions that align with their financial needs and academic goals. Always explore scholarships and grants first, and borrow responsibly to manage your future dues effectively.

FAQs

1: What are the minimum income requirements for personal loan eligibility?

Minimum income requirements vary, from Rs. 35,000 to Rs. 50,000. Visit the HEC website and the specific bank from which you are borrowing the loan amount for detailed guidelines.

2: If I want to study overseas, can I apply for a student loan?

Yes, certain programs and scholarships facilitate studying abroad. Explore options like the Fulbright Program or Commonwealth Scholarships. Duniya consultants offer loans for studying abroad.

3: What happens if I default on my student loan repayments?

Defaulting can lead to legal consequences and affect your credit score. Consult legal resources or the bank’s terms for specifics.

4: What scholarship options are available in Pakistan?

Websites like Scholarship Corner list numerous websites. From sources across the web, I found these websites. Consult with a scholarship advisor for personalized guidance.

- Chevening Scholarship

- Higher Education Commission

- Alfalah scholarship scheme

- Dalda Foundation Scholarship

- HEC scholarships

- Pakistan Engineering Congress scholarship

- DAAD scholarships

- Fulbright Scholarship